Farm Management

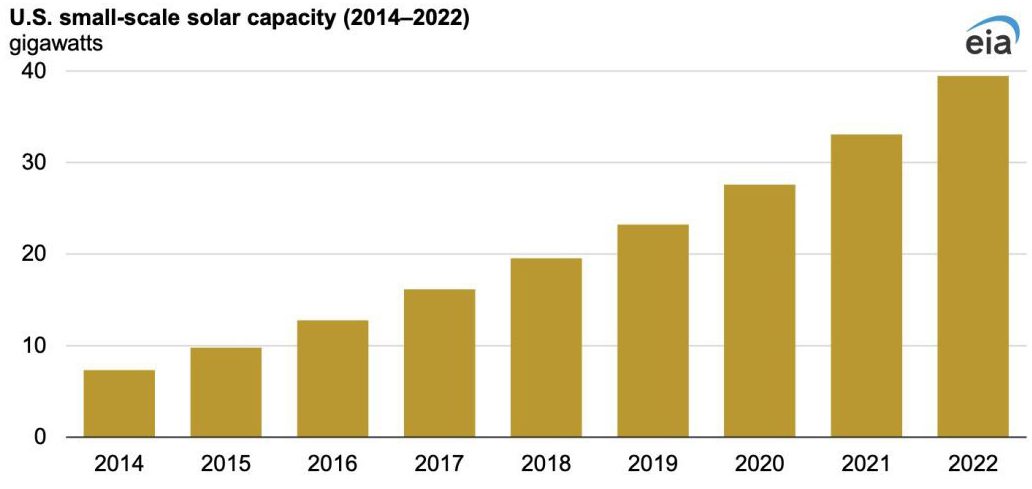

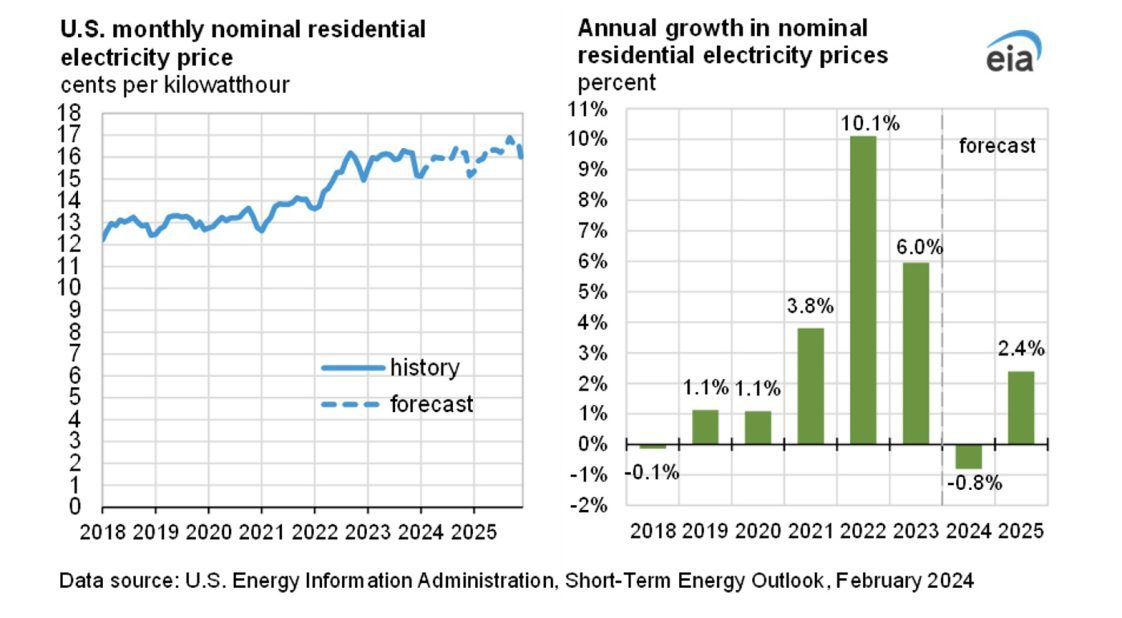

As commercial poultry growers have improved housing insulation and tightened up old, leaky houses, heating efficiency has improved and fuel costs have declined. However, as overall bird size has increased across the United States, keeping larger birds properly ventilated and cool with exhaust fans has driven electricity costs up. The short-term forecast for electricity may be positive, but the overall trend is increasing prices. The use of small-scale solar technology has also increased across the country. It is one of the avenues that poultry growers have explored to help lower their electricity bills by offsetting their utility grid power usage. Currently there are significant federal incentive programs that make solar on poultry farms more attractive. Some solar components have decreased in price, as well. However, as with many things, buyers should do their research.

Considerations

Solar Incentives

US Small-Scale Solar Capacity (2014-2022)

Current solar incentives have the potential to pay for a large percentage of a solar project. The most impactful incentive is the United States Department of Agriculture (USDA)’s current Rural Energy for America Program, commonly known as a REAP grant. Currently, the REAP program offers up to 50 percent of the installation cost of a qualifying project to be covered by the grant. It is important to understand that these grants are competitive and the funding is limited. They are also not funded up front but are reimbursement grants. The REAP grant is by far the most available opportunity for poultry growers to obtain assistance for solar projects. It is advised that a grower obtain the services of an experienced grant writer or technical service provider (TSP) to help complete the grant application. Oftentimes a solar installation company will have secured the services of a grant writer or have someone with that skill set on staff. These services usually carry a fee that is often not charged unless a grant is secured. For more information on the REAP program, visit the USDA’s website at www.rd.usda.gov.

Federal Income Tax Credit

Another consideration is the Federal Income Tax Credit (FITC) available for qualifying solar energy projects. Currently, the FITC is set for 30 percent of the installation cost taken off owed taxes. The tax liability can be taken forward 22 years and look back 3 years. There are additional discounts added if certain system criteria are met. There is an additional 10 percent tax credit applied, based on the use of qualifying US made materials. If the system is being installed in a historically low-income area, an additional 10 percent credit is applied.

Data Source: US Energy Information Administration, Short-Term Energy Outlook, February 2024

The problem for many poultry growers is that they typically do not have high tax liability until later in the farm’s life, after depreciation is used up. Then, this usually coincides with the need for equipment replacement and heavy maintenance requirements, which often require refinancing or additional loans. This is one reason the FITC incentive portion of the solar option may be more fitting for farms that have paid off poultry houses and are expecting to incur heavy tax liabilities. However, there is now an opportunity for growers to sell the unused tax credits at a reduced cash value as part of the Clean Energy Tax Credit program passed under the The Inflation Reduction Act of 2022 (IRA) (Pub. L. 117-169, 136 Stat. 1818 (2022)).

Utility Company Agreements

The final thing to discuss—but the most important to consider with the solar option—is what kind of solar deal a grower has with their current utility company. If a grower has anything less than one-to-one net metering, then it is most likely that a system that offsets less than 100 percent of total power usage will be best suited to a poultry farm. Due to the irregular usage patterns of poultry houses, large systems have the potential to put a lot of excess power back into the grid at low buy-back prices to the grower. In most situations examined where there is something less than full net metering, poultry farms optimally achieve 60 percent or less power offset, depending on the cost of the electricity and the price given to the grower for excess power. Therefore, growers should not think of the incentives as a way to offset more power by installing larger systems but use the incentives to pay off an optimized system sooner rather than later.

More Information

This article was reproduced from the original publication on Southern Ag Today.

For more information and to sign up for the free, digital periodical, visit southernagtoday.org/. Learn more about the Alabama Extension Farm and Agribusiness Management team and read more from them by visiting the Farm Management section of www.aces.edu.